China Hedging Its Bets Amid Economic, Virus Woes – Analysis

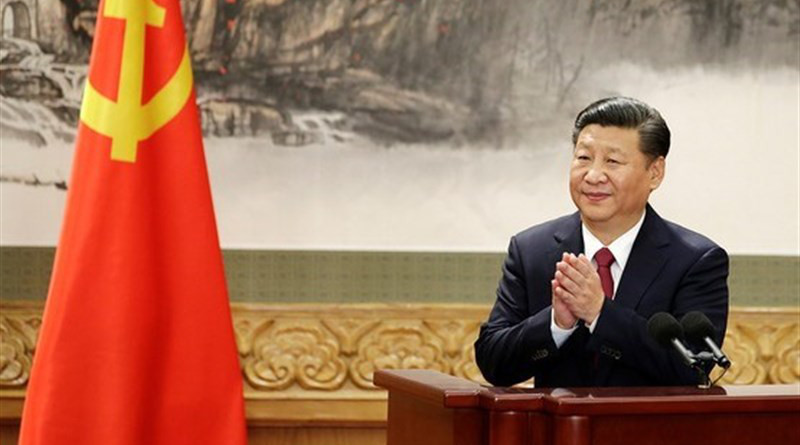

What is happening to China is exactly what Beijing did not want in the new geopolitical arena. Since late last year, and while there is war in Europe, it is facing a situation where President Xi Jinping has had to hedge his bets. China is being hit by a number of different economic and pandemic-related crises, on top of energy shortages and other growing problems. Together, they are hampering the country’s ability to do what may have been on its near-term agenda — a helping Russia more robustly for example.

This is not to say that China is limp. In fact, quite the opposite. Beijing is active all over the world in construction, communications, mining and other infrastructure developments. Africa and Latin America are, in particular, decades-old spots of interest and development.

Moreover, China’s defense industry is at full speed producing more jet fighters, naval combatants and missile systems than one can count. China has hundreds of ballistic missiles in the southwest of the country, a factor that has been forgotten in mainstream policy thinking. China’s largest deployments of troops overseas in the post-Cold War era have been on UN peacekeeping missions. It has only one official military base on foreign soil — in Djibouti, which was created in 2017, at least officially. There are dozens more places where access rights with host governments play a key role.

China’s woes began in October last year, when heavy rains created massive problems for the coal-producing provinces in the north. In Shanxi Province, which produces a third of China’s coal, dozens of mines were forced to temporarily shut down due to flooding. The flooding further complicated China’s efforts to increase fuel supplies to ease its deepening energy crisis. It also complicated efforts to control the price of power and coal, which have shown volatility.

Energy products for Chinese industry are key. At the time of the floods, the fuel shortage cut China’s industrial power dramatically. This meant that Chinese industry suffered a major slowdown in activity in energy-intensive sectors, such as cement-making, chemicals and steel. Logistics companies reported a jump in their backlog of work, with supply chain logjams. The market oscillation as a result of the strain on Chinese industry illustrated a vulnerability in its infrastructure. What the episode also showed is how Chinese power outages, if they last for an extended amount of time, can affect production and rollout across the global economy. This is an issue to watch.

COVID-19 is now an issue again for China, challenging authorities on top of the economic landscape. With the pandemic surging in Shanghai, a two-stage, nine-day lockdown of the city is going to have a staggering effect on Chinese healthcare workers and across industry.

Other cities, such as Shenzhen, Dongguan, Changchun and Shenyang, have already faced strict but short-lived lockdowns in China’s ongoing battle against rising cases of the omicron variant. And more lockdowns could be possible, as the authorities seem intent on maintaining strict restrictions in the country. Meanwhile, surging energy and raw material costs in China are driving an upswing in industrial profits, while downstream producers pay the price.

China’s use of swift lockdowns in early 2020 helped the country quickly reopen businesses while much of the world struggled to contain the virus and resume normal activity. Now, the country is in trouble again. China’s “zero-COVID” strategy has failed. Chinese policymakers have instead tried targeted measures to keep ports or large factories running.

Consequently, the Chinese economy is not doing well. According to research, profits at China’s major industrial firms rose 5 percent year on year in the January-February 2022 period, up from 4.2 percent in December 2021. Revenue is up across the board in the broad industrial sector, which covers everything from coal mining to beverage production and auto manufacturing. But these are not good economic numbers for China. This is perhaps why it is taking a less risky foreign policy approach, as Beijing can see the level of sanctions activity due to Russia’s war in Europe.